Does Financial Need and Aid Differ for Online and On-Campus Students?

Published by: WCET | 10/8/2021

Tags: Managing Digital Learning, Online Learning, ROI, Student Success

Published by: WCET | 10/8/2021

Tags: Managing Digital Learning, Online Learning, ROI, Student Success

It started before COVID-19. Students, families, businesses, and those considering college questioned the value, the “return on investment” (ROI), of postsecondary education. Could they do better doing something else? Was the debt worth it? Is college for them?

Those questions loomed larger during the pandemic and we know they will keep coming in the future. Luckily, the WCET Steering Committee is currently hosting a several-week examination series of ROI – with special consideration (if possible) on how digital learning can make an impact in the equation.

Today, specifically, we have an insightful post from Shannon Riggs and Jessica DuPont, both from Oregon State University’s Ecampus. Shannon and Jessica share updates on online learning trends and information on financial need and aid availability for online students. They also share specific examples of the impact of these topics on their students. Thank you to Shannon and Jessica for this great post!

Also – a quick favor. WCET is interested in learning more on this topic and would appreciate you taking a quick (less than 5 minutes!) survey on financial aid and need for online students. Help us learn more.

Enjoy the read and enjoy your day,

Lindsey Downs, WCET

Higher education leaders often discuss affordability as a roadblock to persistence and success for traditional students entering college directly after high school. Affordability is also a barrier for nontraditional learners who are primarily working adults balancing the costs of education in addition to raising a family and paying rent or mortgage and other household bills. As higher education administrators focused on educational technology and policy, understanding the financial aid and scholarship landscape at your institution is foundational to knowing how and where to offer support to your students – including adult learners – so they can cross the finish line. Understanding what data you should be collecting about your online students and knowing how aid is awarded are key to developing practices that will ultimately increase access to education for the growing population of adult learners.

Student demographics and choice of modalities have been changing, even before the pandemic. In a 2019 Online Learning Market Update, Eduventures projected that by 2025, 22% of all university students in the U.S. will be fully online. At Oregon State University, one in four students is now a fully online student through our centralized online learning division, Ecampus, up from one in five the previous year. In 2020-21, just over 8,000 Oregon State students out of approximately 32,000 students were an online learner any given term. Our online students are primarily adult learners with an average age of 31. The largest segment of online students at Oregon State is motivated to finish their first bachelor’s degree and typically transfer in with credits and student loan debt accumulated from previous institutions.

The numbers of traditional campus-based students at four-year institutions have been steadily decreasing since 2013 due to a high school population decrease or plateau. Now it’s time to shift our gaze to better understand the financial needs of the adult learner population, which is projected to increase in the future. According to the National Student Clearinghouse Research Center’s Some College, No Degree report, approximately 36 million Americans have attended some postsecondary education but have not completed and are no longer enrolled. Data from this study suggest that “10 percent of the population or 3.5 million individuals, have a high potential to attain a credential because they already have finished two years of full-time over the previous 10 years.”

Familiarity with the data from your own institution is important in helping to identify gaps in support for online students. A great start is to be able to answer the following questions about your students’ financial:

It’s worthwhile to note that Financial Aid offices may be reticent to share Pell data due to federal restrictions. At Oregon State, our Financial Aid office came up with a proxy: internal calculations for high-, medium- and low- financial need.

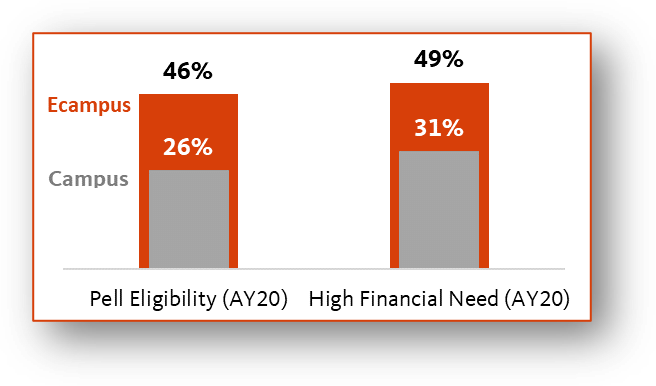

Answers to the questions above were alarming for us. When we split out campus (more traditional-aged) and online (more adult learners), we learned that, in 2019-20, of students seeking their first bachelor’s degree, a much higher percentage of Ecampus (online) students had a high financial need compared to campus students. In fact, nearly half of our Ecampus students (49%) had high financial need compared to 31% of campus students with high financial need.

The Office of Federal Student Aid, an office of the U.S. Department of Education, provides more than $120 billion in federal student aid, which includes grants, work-study, and loan funds each year to help pay for college or career school. Unfortunately, many adult learners have issues with lifetime limits being exhausted from taking previous credits at other institutions. Additionally, college students are not eligible for direct loans if they take fewer than the required number of credits per term or semester. At Oregon State, 84% of fully online learners pursue their degree part-time. Direct loan eligibility requires taking at least half of a full-time load, which amounts to six quarter term credits, typically two courses each term at our university. If a student takes less than six credits, they are not eligible for these loans. Fortunately, Pell grants are incrementally adjusted for part-time status.

Institutional awards and scholarships can greatly lessen the list price of tuition for students, but it’s imperative to know how institutional aid is allocated to your online students. At Oregon State, we learned that many of our institutional processes around financial aid and scholarships still cater to the traditional on-campus learner in spite of online adult learner growth trends. For example, many scholarships require full-time attendance. Others are set up for those admitting for the fall term, when online, adult learners may be starting in any quarter term. Additionally, when we looked into scholarship dollars allocated by audience, we found that the vast majority of available funds are distributed to traditional campus-based students. This is despite the fact that at our institution, online students have greater financial need. Now representing 1 in 4 of all Oregon State students, Ecampus online students received less than 5% of total scholarship funds awarded through our campus-wide scholarship management system over the past academic year.

Yet another significant difference in financial aid resources for online and on-campus students is the GI Bill, specifically with how housing allowances are allocated. The GI Bill benefit includes a monthly housing allowance, which is based on housing costs where the institution is located. In areas where housing is more expensive, the allowance is greater, and it is lower where housing is more affordable. On-campus students receive the full housing allowance per month based on their institution’s zip code and the cost of housing at that location. However, regardless of where a student lives, if they pursue their degree 100% online, they receive only half of the national housing allowance average. Half.

For veteran students using this earned benefit, the difference amounts to hundreds of dollars per month. A veteran student at OSU’s Corvallis campus using the GI Bill receives $1,788 per month as their housing allowance. A veteran student pursuing the same exact OSU degree online, however, will receive only $916.50, a difference of $871.50 per month. At Oregon State Ecampus, most of our programs are online versions of programs that are also offered on-campus. Courses meet the same learning outcomes regardless of modality and are often taught by the same faculty teaching on campus.

Why is the housing allowance reduced so sharply simply because a veteran student elects to pursue a degree online? Student housing needs are not diminished if they pursue their degrees online, so the rationale for this inequitable distribution of this earned veterans’ benefit is not clear.

What is clear is that we have work to do in ensuring that financial aid resources are as available to adult learners studying online as they are for traditional students studying on campus.

At Oregon State, the online student data surrounding high financial need coupled with the lack of institutional scholarships provided enough of an incentive to better advocate for our students and more formally collaborate with campus partners who could help. We still have work to do, but we are committed to reducing barriers for our students.

What can you do to help online students at your institution? We have a few ideas:

Idea #1:

Learn how scholarships and institutional aid are awarded at your institution. Your Financial Aid and Scholarship offices can help. Ask how fully online students are included in and awarded scholarships. If they aren’t, can they be? Higher education institutions have the oversight to offer a variety of aid to their students at their own discretion, including recruitment scholarships, hardship grants, completion grants, additional military aid, and merit scholarships.

Idea #2:

What budget do you have available to create your own grants specific to online learners? At Oregon State Ecampus, and over the years, these have included hardship grants, additional military aid, completion scholarships and re-enroll incentives – all for online students.

Idea #3:

Partner with academic colleges, especially those with the largest online programs. Scholarships are often overseen and awarded in a decentralized manner. At Oregon State, we have more than 40 scholarship administrators. Our division of Ecampus has recently created agreements with half of our eight partnering colleges that include matching funds to award scholarships to online students, especially those who may not be eligible for other college scholarships.

What ideas do you have? We’d love to hear them.

A quick reminder – WCET is interested in learning more on this topic and would appreciate you taking a quick (less than 5 minutes!) survey on financial aid and need for online students. Help us learn more.

Executive Director of Market Development and the Student Experience, Oregon State University Ecampus

Associate Vice Provost of Educational Programs and Learning Innovation, Oregon State University